Chapter 6: How Much Money is Required for Options Trading?

Margin is the amount which is kept as a deposit that acts as collateral for the exchange in case an options trader makes losses due to increased volatility.

A trader who wants to trade in futures and options needs to deposit margin money with the broker, as prescribed by the exchange ( subject to change from time to time-based on market volatility). The broker deposits this collected margin money with the exchange on the trader’s behalf.

Prices of underlying shares in the F&O markets keep on moving every day. And since there’s leverage involved, margins ensure that buyers bring money and sellers bring shares to complete their obligations even though the prices have moved down or up.

In India, SEBI urges exchanges to ensure that the margin requirements are met at all times. Any irregularities in maintaining margins by the exchanges or shortfall in margins at the trader’s end, can lead to hefty penalties for both.

Mr Vikalp Starts Options Trading

After going through the previous Chapters, Mr Vikalp , a super cash market trader gets a fair idea on options trading basics and he sort of gets how options premiums work.

Now Mr Vikalp is ready to try his hands on options trading and he contacts his broker Dhan as they have a dedicated app for Options Trading. He also wants to know how much capital is required to trade in Options.

To get started, Mr Vikalp needs to first open a Futures and Options Trading account with the broker and has to keep some capital as margin. Mr Vikalp has two options (literally) and the margin requirements for each will vary.

If Mr Vikalp wants to buy an option premium at any strike price, then the margin required will be calculated as follows.

Margin for Option Buying

Lot Size * Premium Price

If Mr Vikalp wants to sell options contracts then the margin required would be as follows.

Margin for Option Selling

SPAN margin (Initial Margin) + Exposure margin + Additional margin required by the exchange – Premium Amount received

Let’s take an example. Mr Vikalp wants to trade in stock options. He’s looking at Reliance Industries and wants to take exposure in the stock by buying and selling options.

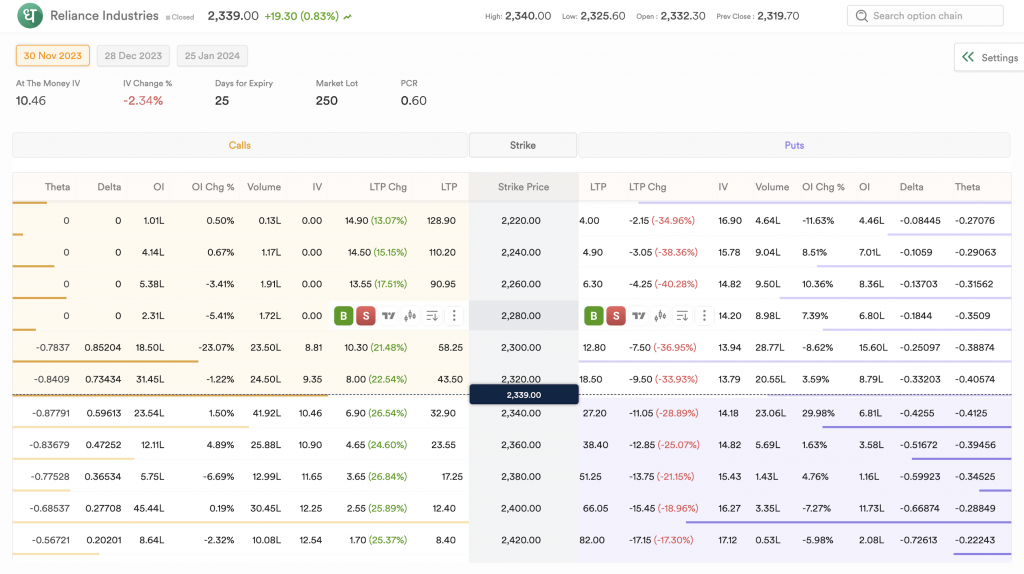

Show below is the option chain of RIL, displaying a holistic view of the currently traded most active call and put options strike prices at the CMP of Rs. 2339.

Mr Vikalp has 3 choices. Let’s have a look –

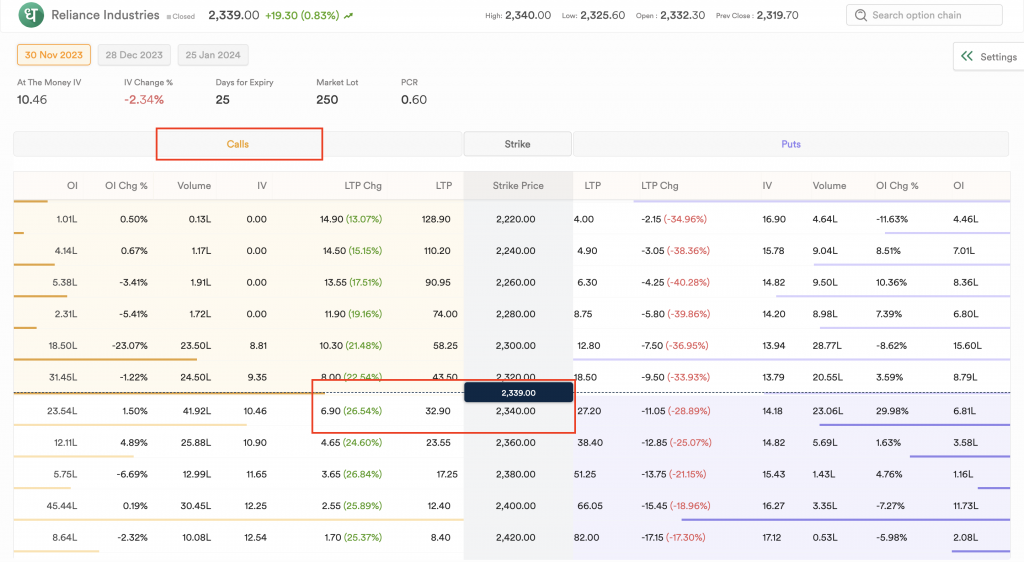

Case 1: Mr Vikalp is bullish on Reliance and wants to buy a Call Option. He is looking to buy an ATM Call Option with a strike price of 2340.

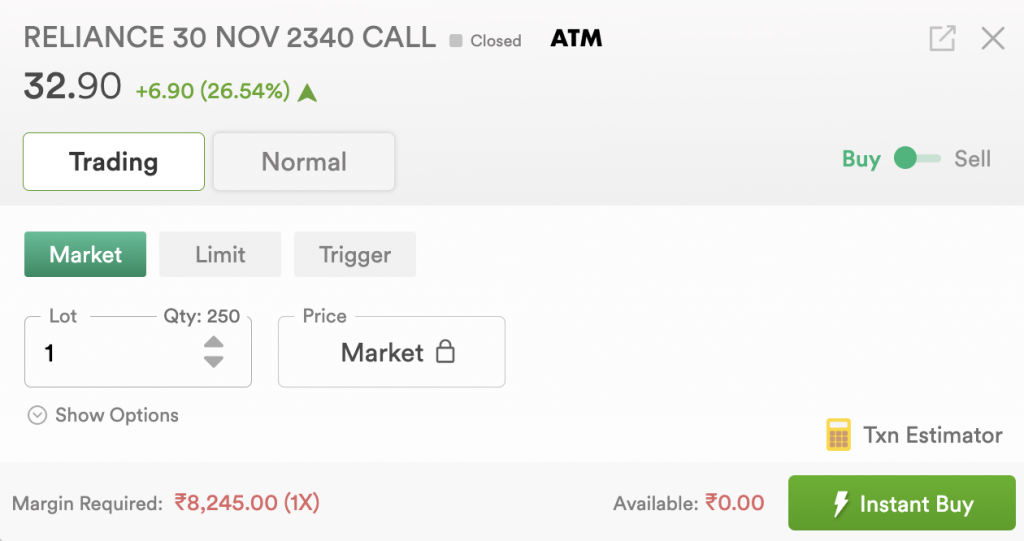

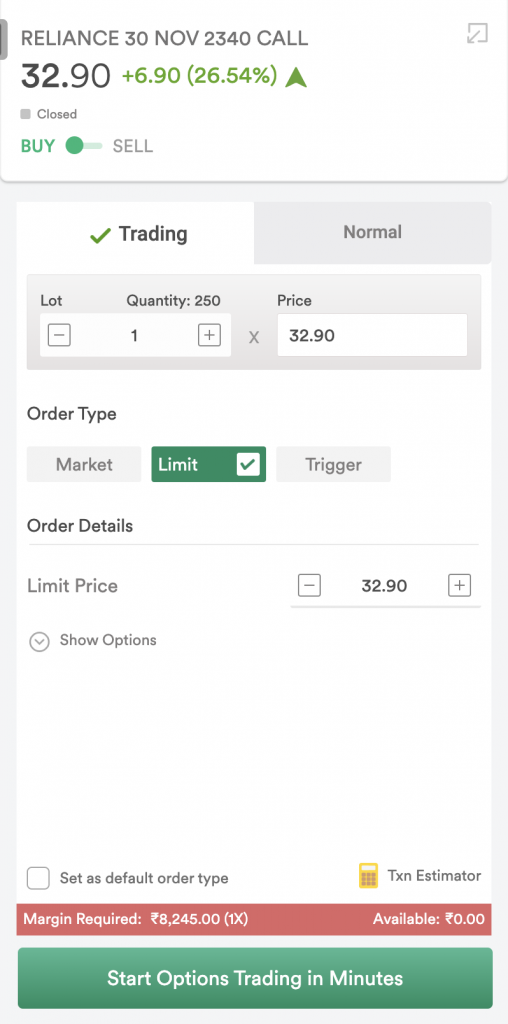

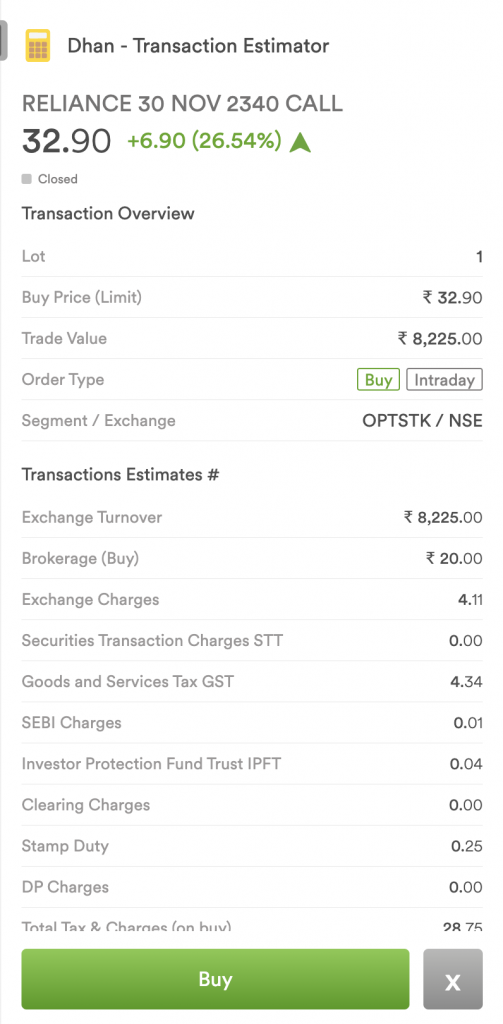

As you can see the , to buy 1 lot of RELIANCE 31 AUG 2540 CALL lot size is 250 shares, Mr Vikalp has to pay Rs 8245/- (1 lot = 250 shares * 32.90/- premium price).

Here is the breakup of the entire transaction with the TXN Estimator on Dhan.

The net amount payable is inclusive of all the charges such as brokerages, exchange charges, stamp duty and taxes.

The calculation is for 1 lot, and if he wants to buy more, then he will need to add more funds and multiply the lot size of 250 shares * the premium price which is 44.10.

Please note: Information in the Transaction Estimator is approximate, not actual.

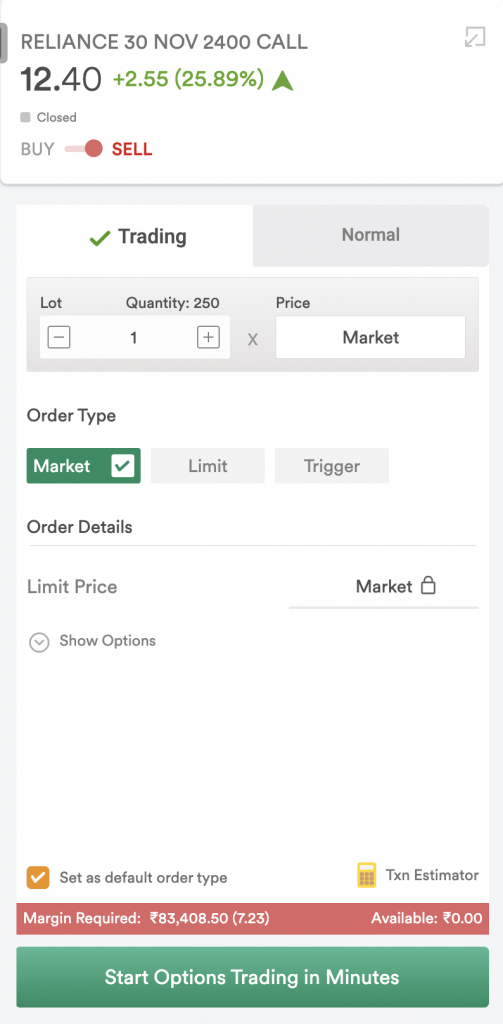

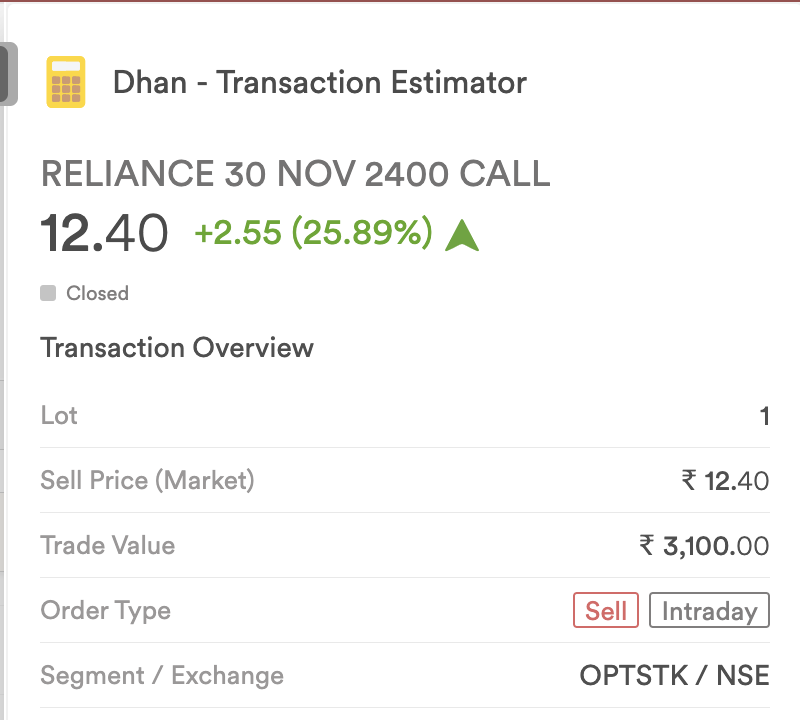

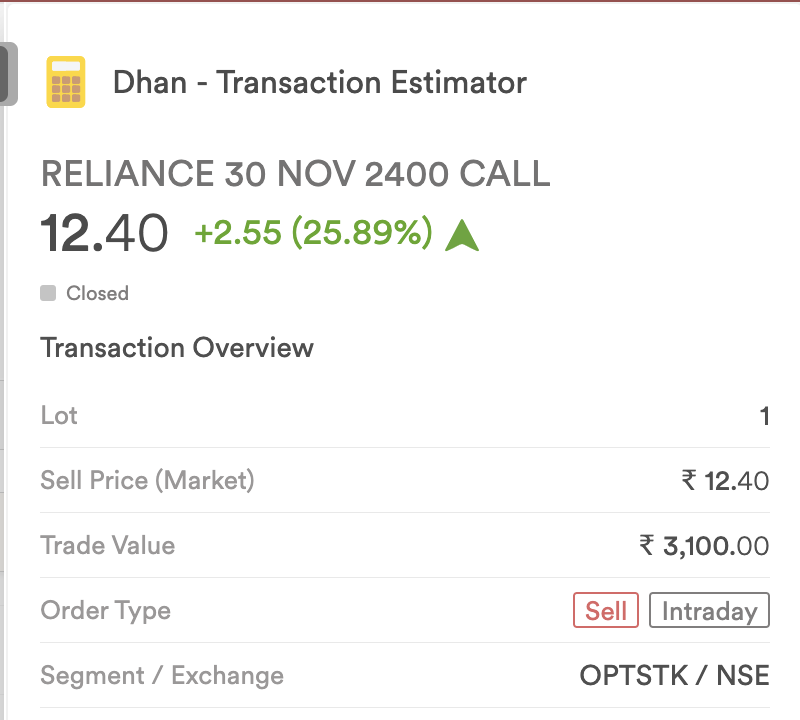

Case 2: Although Mr Vikalp is bullish on Reliance , he has a view that the underlying price of Reliance may not go above 2600. And so he wants to speculate and decides to sell the RELIANCE 31 AUG 2600 CALL which is currently trading at 22.80.

Now, Mr Vikalp’s capital requirement increases as option selling indeed has a higher risk. He needs Rs. 98272.56 as an upfront margin to execute the option-selling trade. Although the trade value is only Rs. 5700, Mr Vikalp will need to pay additional margins required by the exchange to fulfil his sell order.

Here’s the breakup of the transaction on the transaction estimator.

Let’s take one more example here on the index options. Mr X has a neutral view on the Bank Nifty which is a leading index comprising stocks from the banking sector. Based on this he plans to sell both call and put options and benefit out theta decay.

Case 3: Non-Directional Option Selling.

The CMP of Bank Nifty Spot is 44199.10

Mr Vikalp decides to sell a straddle, which is a non-directional strategy used when the market is expected to be range-bound or less volatile. We’ll discuss options strategies later. For now, let’s understand margin requirements with this example.

As you can see, the overall margin requirement for this strategy is roughly 1 lac rupees. While selling just one leg either call or put would require a margin of 87415 (as shown in the image below).

The reason margin is lesser is that exchanges have designed the margin requirements in such a way that they give away hedge benefits if both the options are sold, or if you hedge you trade by creating a spread, that is taking a counter position instead of selling a single option for protecting losses.

Coming to the basic question of how much money is required for options trading?

The answer is that it depends on how much quantity you’re comfortable with. But the minimum money requirements for options trading will always depend on the margins prescribed by exchanges.

By the way, margins are subject to changes by the exchange based on the volatility in the markets.

At Dhan, we have an in-built feature which automatically tells you the current margin requirements, so there’s no need for you to check the margin every time you take a trade!

Just search for the stock or the index options you want to take buy or sell positions, and as shown in the above examples, the margin requirements will be shown to you at the bottom.

All Types of Options Margins Explained

In order to start trading in Options , exchanges in India need you to deposit margins. These margins are a combination of cumulative margins such as

1. Initial Margin a.k.a. VaR Margin or SPAN Margin

SPAN generates different scenarios by assuming different values to the price and volatility and for each of these scenarios, possible loss that the portfolio would suffer is calculated.

Based on this, the initial margin required to be paid by the investor that would be equal to the highest loss the portfolio would suffer in any of the scenarios considered.

The margin is monitored and collected at the time of placing the buy / sell order. The SPAN margins are revised 6 times in a day:

Once at the beginning of the day

4 times during market hours

Once at the end of the day

Goes without saying, higher the volatility, higher the margins.

2. Exposure Margin

Exposure margin is collected along with Initial/SPAN margin. Exposure margins in respect of index futures and index option sell positions is 3% of the notional value of the contract.

For futures on individual securities and sell positions in options on individual securities, the exposure margin is higher of 5% or 1.5 standard deviation of the log returns of the security (in the underlying cash market) over the last 6 months period. It is applied on the notional value of position.

Premium Margins: It is charged to buyers of option contracts in addition to the Initial margin. We saw this in our examples above.

The premium margin is paid by the buyers of the options contracts and is equal to the value of the options premium multiplied by the quantity of options purchased.

Assignment Margins: It is collected on assignment from the sellers of the contracts.

With this we come to an end to this Chapter. In the coming Chapters we shall discuss how to choose the right financial instruments for trading and then touch on some more interesting option trading aspects.